Marketing restrictions could destroy billions of dollars in the enterprise value of big brands in the alcohol, confectionery, savory snacks, and sugary beverage industries. Following the introduction of marketing restrictions on tobacco products, there have been repeated calls for the legislation to be extended to other products that have a negative impact on consumer health.

The Tobacco Advertising & Promotion Act 2002 was enacted in the United Kingdom in November 2002, with most advertising and sponsorship banned from February 2003. This year, around 26% of all UK residents smoked – but that number has fallen to just over 14% in 2019 – far fewer people exposed to the potentially deadly effects of long-term tobacco use. Now, many health experts suggest that similar marketing restrictions in other industries could have similar benefits.

According to the British Heart Foundation, around 31,000 cardiovascular deaths are attributed to obesity each year – much like the effects of smoking. To discourage consumers from buying obesity-related products, the UK government confirmed plans in June 2021 to restrict advertising on foods high in fat, salt and sugar. This commitment follows calls from us and a number of other leading health organizations to action. Measures that will be decided include a watershed for junk food advertisements on TV at 9 p.m. to reduce their impact on children, as well as other restrictions on online advertising.

Interestingly, the new measures in the UK are not met with much opposition from marketers. A survey by the Chartered Institute of Marketing found that only 26% of the UK’s top 50 marketing executives think the current regulations are fit for purpose, while half support further marketing restrictions on foods rich in fat, salt and sugar.

As with the smoking ban, however, the UK is not alone in making these potential changes. At the global level, in the short term, these changes will come with their fair share of economic disruption. The food and beverage industries are at risk of losing a whopping $ 521 billion to marketing restrictions, according to a new report from Brand Finance.

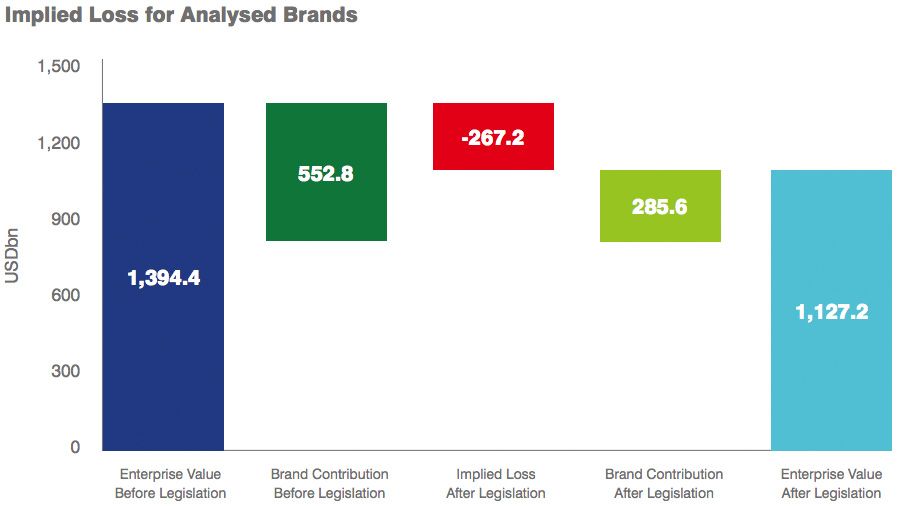

Currently, the world’s food and beverage industries combined are worth $ 2.4 trillion – but under legislation restricting the sale of alcohol, confectionery, savory snacks, and sugary beverages, that value could reach $ 1.9 trillion sink. Brand Finance found that more than half of the depreciation in value would come from just nine of the world’s largest food and beverage brands: AB InBev, The Coca-Cola Company, Diageo, Heineken, Mondelēz International, Nestlé, PepsiCo, Pernod Ricard, and Treasury Wine Estates.

The nine branded titans could lose a total of $ 267 billion in corporate value if marketing restrictions were put in place. On average, the companies affected could each lose almost a quarter of their company value and more than 50% of their brand contribution. The Coca-Cola Company’s flagship brand, Coca-Cola, is estimated to have suffered the most from a raid on sugary beverage marketing – with a loss of $ 43 billion (most of the company’s total projected loss of $ 57 billion) . Meanwhile, PepsiCo’s flagship brand, Pepsi, is facing a $ 23 billion plunge. Nestlé’s entire empire could be faced with a $ 38 billion decrease in company value in the meantime.

While most people may not shed tears for the infamous global empires – some of which have been haunted for decades by allegations about their environmental impact, attitudes to job rights, and tax evasion – it can have far-reaching economic implications for their loss of income. According to David Haigh, Chairman and CEO of Brand Finance, there is one less option for investors to preserve value during the economic turmoil witnessed during the pandemic when capital is unable to cope with market certainties that are currently unhealthy products.

Haigh commented, “Brands are an integral part of how the world works. In times of crisis, brands – especially the most valuable and strongest in their categories and markets – become a safe haven for capital. Well-managed, innovative and reputable brands are what the global economy turns to in the hour of need. Tight marketing restrictions are catastrophic, not just for brands, but for all stakeholders, from consumers and society to investors and governments. “